For folks working in public service across Ohio, a big part of planning for what comes next often involves thinking about their future and how they will be supported. It is that feeling of security, a sense of calm about what lies ahead, that makes a real difference when you are building a life and a career. Knowing there is a system in place to help you and your loved ones after your working days are done brings a lot of peace of mind, and that is where the Ohio Public Employees Retirement System, often called Opers Ohio, steps in for more than a million public employees.

This organization has been a steady presence for many, many years, offering a kind of safety net for those who dedicate their working lives to public service. It is not just about getting a paycheck now; it is very much about making sure you have a dependable income stream and other important provisions once you decide to step away from your job. Opers Ohio is there to provide retirement income, help if you become unable to work, and even support for your family if something unexpected happens.

As you move through your working life, and even as you consider what retirement might look like, Opers Ohio aims to be a helpful companion. They have set up ways for you to keep track of your benefits, learn about your options, and generally stay connected with them. It is all about making sure you feel informed and supported, so you can focus on your work today while also feeling good about the financial picture of your tomorrows, you know, for yourself and for those who depend on you.

Table of Contents

- What Does Opers Ohio Offer You?

- Your Support System Through Public Service with Opers Ohio

- Staying Connected - Your Opers Ohio Online Account

- How Can Your Opers Ohio Account Help You?

- Understanding Your Opers Ohio Membership

- What are the Different Opers Ohio Plans?

- Planning for Tomorrow with Opers Ohio

- What About Healthcare and Opers Ohio?

What Does Opers Ohio Offer You?

For those who dedicate their careers to serving the public in Ohio, knowing there is a reliable source of support for the future is a big deal. Opers Ohio, which stands for the Ohio Public Employees Retirement System, is built around this idea. They provide a range of important financial provisions designed to give you peace of mind, not just when you stop working, but also if life throws you a curveball. This means they are there to help with your regular retirement income, offer assistance if you become unable to work due to a disability, and even provide support for your family members after you are gone. It is a system that, in some respects, has been a cornerstone for millions of Ohio's retired public workers and their families since it began way back in 1935, offering a steady hand and a sense of security for many, many years.

The core purpose of Opers Ohio is to ensure that public employees across the state, who are not already part of another state or local retirement plan, have a dependable financial future. This includes folks working in various roles, from teachers and librarians to city workers and state employees. It is a broad group of people, all contributing to the well-being of Ohio, and Opers Ohio is there to back them up. They understand that a secure retirement is not just about money; it is about feeling good about your later years, knowing you can enjoy them without constant financial worry. So, their offerings are pretty comprehensive, aiming to cover different life situations and provide a solid foundation for your financial well-being, both now and in the future.

Your Support System Through Public Service with Opers Ohio

Opers Ohio really sees itself as a trusted companion throughout your entire working life in public service and even into your retirement years. They are not just an organization that sends out checks; they are a resource that tries to be there for you every step of the way. This means they offer a variety of programs and information to help you understand your benefits and make good choices for your future. For instance, they have publications like a handbook for those receiving benefits and a guide to help with income tax questions related to your Opers Ohio payments. These resources are designed to give you the facts you need in a straightforward way, helping you sort through things like how your benefits are calculated or what to expect when it comes to taxes. It is all part of their effort to make sure you feel supported and well-informed, which is, you know, a pretty big deal when you are talking about something as important as your financial future.

- Air Transport International

- Pirate Show

- Howell Nature Center

- Black Forest Industries

- Tantalum Restaurant Long Beach California

Beyond just the financial provisions, Opers Ohio also recognizes that there is a lot to consider when you are planning for retirement. They provide information and guidance to help you think through these important decisions. While they are not legally required to offer health care coverage, they do acknowledge how vital it is for a secure retirement. They want you to be aware that once you stop working, your employer's group medical plan will no longer cover you. This means you will need to think about your health care options as you get ready to retire. They aim to be a source of information as you transition from your working days into your retirement years, helping you consider all the pieces of the puzzle that make up a comfortable and worry-free future. It is, in a way, about providing a complete picture, not just one part of it.

Staying Connected - Your Opers Ohio Online Account

In today's busy world, having easy access to your personal information is super helpful, and Opers Ohio gets that. They have created an online account, which is a really handy way to keep in touch with them throughout your public service career and even after you have retired. Think of it as your personal hub for all things related to your Opers Ohio benefits. You can look at your information whenever it suits you, whether that is in the evening after work or on a quiet weekend morning. This means you do not have to wait for office hours or make phone calls for every little thing. It is all about putting the power to manage your retirement planning right at your fingertips, which, you know, makes things a whole lot simpler for everyone involved.

This online account is more than just a place to view your details; it is an active tool you can use. For example, when the time comes, you can actually use it to put in your application for retirement. That is a pretty big step, and having the ability to do it conveniently online can really ease the process. To help you get the most out of this tool, Opers Ohio has put together a series of videos on their YouTube channel. These videos walk you through different features of the online account, showing you new ways it can be a benefit to you. It is a good way to learn how to make the most of what is available, ensuring you are comfortable and confident using the system to manage your future.

How Can Your Opers Ohio Account Help You?

So, you might be wondering, what exactly can you do with this Opers Ohio online account? Well, it is designed to be your central spot for managing your retirement provisions. You can use it to keep an eye on your account details, which is pretty important for planning your future. It also allows you to see information about the various benefits you might be eligible for. This means you can stay well-informed about your public pension plan without having to dig through stacks of papers or make repeated phone calls. It is all right there, organized and ready for you to look at whenever you need to. This kind of easy access helps you feel more in control of your financial planning and keeps you connected to the system that supports you.

Beyond just viewing information, the Opers Ohio member portal is set up to help you take action. You can update your contact information, check on the status of your applications, and generally stay current with any changes or news from the Ohio Public Employees Retirement System. It is a way to make sure that you are always in the loop and that your information is correct and up-to-date. This is especially helpful as you move through different stages of your career or approach retirement. Knowing that you can access and manage these important details from your own computer or device really adds a layer of convenience and reassurance, making the whole process of planning for your future feel a little less overwhelming, actually.

Understanding Your Opers Ohio Membership

Your membership with Opers Ohio is a really important part of your overall financial picture, especially if you are a public employee in the state. It is not just about a deduction from your paycheck; it is about building a foundation for your future security. Opers Ohio is responsible for providing retirement income and various other provisions to public employees here, and that is a pretty big job. They work to ensure that when your working days are done, you have a dependable source of income to support yourself. This commitment to providing a stable future is a key reason why your membership holds so much value, offering a kind of steady support that you can count on, you know, for years to come.

The system is set up to cover a wide range of public employees across Ohio, providing retirement, disability, and survivor provisions. This means they are thinking about different life circumstances and trying to offer support where it is needed most. Your membership is essentially your link to these important programs. It is about more than just a simple transaction; it is about being part of a system that has been working for a long time to help people like you secure their financial well-being after a career in public service. So, understanding what your membership means and how it works is a really good step towards making the most of what Opers Ohio offers.

What are the Different Opers Ohio Plans?

When it comes to your retirement with Opers Ohio, you have a few different paths you can choose from, which is nice because it means you can pick what fits your situation best. They offer three main plan options, and understanding these can really help you get the most out of your provisions. Each plan has its own way of working, from how your benefits are calculated to how your contributions are handled. It is a good idea to learn about these different options, because what works well for one person might be different for another. This choice allows you to consider your personal goals and how you see your retirement unfolding, so you can pick the option that feels right for you, in a way.

Besides the different plan options, there are also various groups of people who are eligible for Opers Ohio membership. These groups help define how your benefits might work and what rules apply to your situation. Knowing which eligibility group you fall into is a key piece of information, as it helps you understand the specifics of your membership. Opers Ohio aims to provide clear information about these different plans and groups, so you can make informed choices. They want to help you understand how to make your benefits work as hard as possible for you, ensuring that you are well-prepared for your retirement years. It is about giving you the tools and knowledge to maximize the support you receive from your membership, which is pretty helpful, really.

Planning for Tomorrow with Opers Ohio

Thinking about retirement is a big step, and Opers Ohio is there to help you consider all the pieces that go into a secure future. They have been a source of peace and financial stability for millions of Ohio's retired public workers and their families since their beginning in 1935. This long history means they have a lot of experience helping people plan for their later years. They provide retirement, disability, and survivor programs for public employees throughout the state who are not already covered by another state or local retirement system. This broad reach means a lot of people count on them for their future well-being, and Opers Ohio aims to be a dependable partner in that journey. Their total investment assets, which were about $114.4 billion at a recent count, show the significant resources they manage to support these important provisions.

For those who are part of the Traditional Pension Plan, Opers Ohio offers a benefit estimator. This tool can give you an idea of what your future retirement income might look like, which is incredibly useful for planning. Opers Ohio figures out these defined benefit pensions using a specific way that takes into account your years of service. This means the longer you have worked in public service, the more that could factor into your retirement income. Having an estimator helps you visualize your future and make plans based on realistic expectations. It is a practical tool that, in some respects, brings your retirement a little closer to reality, helping you feel more prepared for what is ahead.

What About Healthcare and Opers Ohio?

When you are thinking about retirement, one of the biggest things on people's minds is often healthcare. While Opers Ohio is not legally required to provide health care coverage, they do understand how important it is for a secure and comfortable retirement. They recognize that having a plan for your medical needs is a huge part of feeling good about your future. So, they want to make sure you are aware of some key things as you get ready to stop working. One very important point to remember is that once you retire, you will no longer be covered under your employer's group medical plan. This is a significant change, and it is something you will need to plan for as you make the shift into retirement. They are there to help you think through these considerations, even if they are not directly providing the coverage themselves, you know.

As you move from your working life into retirement, there will be other adjustments to make as well. Opers Ohio provides information and resources to help you with this transition. They want to be your trusted partner through each stage, from your working career right into your retirement years. This means offering guidance and access to publications that can help you understand all the different aspects of your retirement. For example, they have resources like the benefit recipient handbook and an income tax guide specifically for those who are receiving Opers Ohio benefits. These materials are designed to give you the practical information you need to manage your finances and health considerations as you step into this new phase of life, making the whole process feel a little more manageable, actually.

It is also quite natural to have questions when you are new to Opers Ohio or just starting to think about your retirement. You might wonder, for instance, how much you contribute to Opers Ohio, or when you can actually get access to your money. Opers Ohio aims to provide clear answers to these common questions. They want you to understand the benefits they provide to their members, so you feel informed and confident about your membership. Knowing these details helps you plan better and feel more secure about your financial future, which is pretty much what it is all about, right?

Opers Ohio members contribute a certain percentage of their earnable salary, and this percentage depends on the kind of work they do. Interestingly, an employee's contribution rate stays the same no matter which of the three Opers Ohio retirement plans they pick. Your contributions as a member play a part in helping to fund the pension fund itself. These contributions from members are specifically put into the pension trust fund. However, the money that employers contribute can be used in different ways to support the system. This setup helps ensure that there are enough resources to provide the benefits that public employees count on for their retirement. It is, in a way, a shared effort to build a secure future for everyone involved.

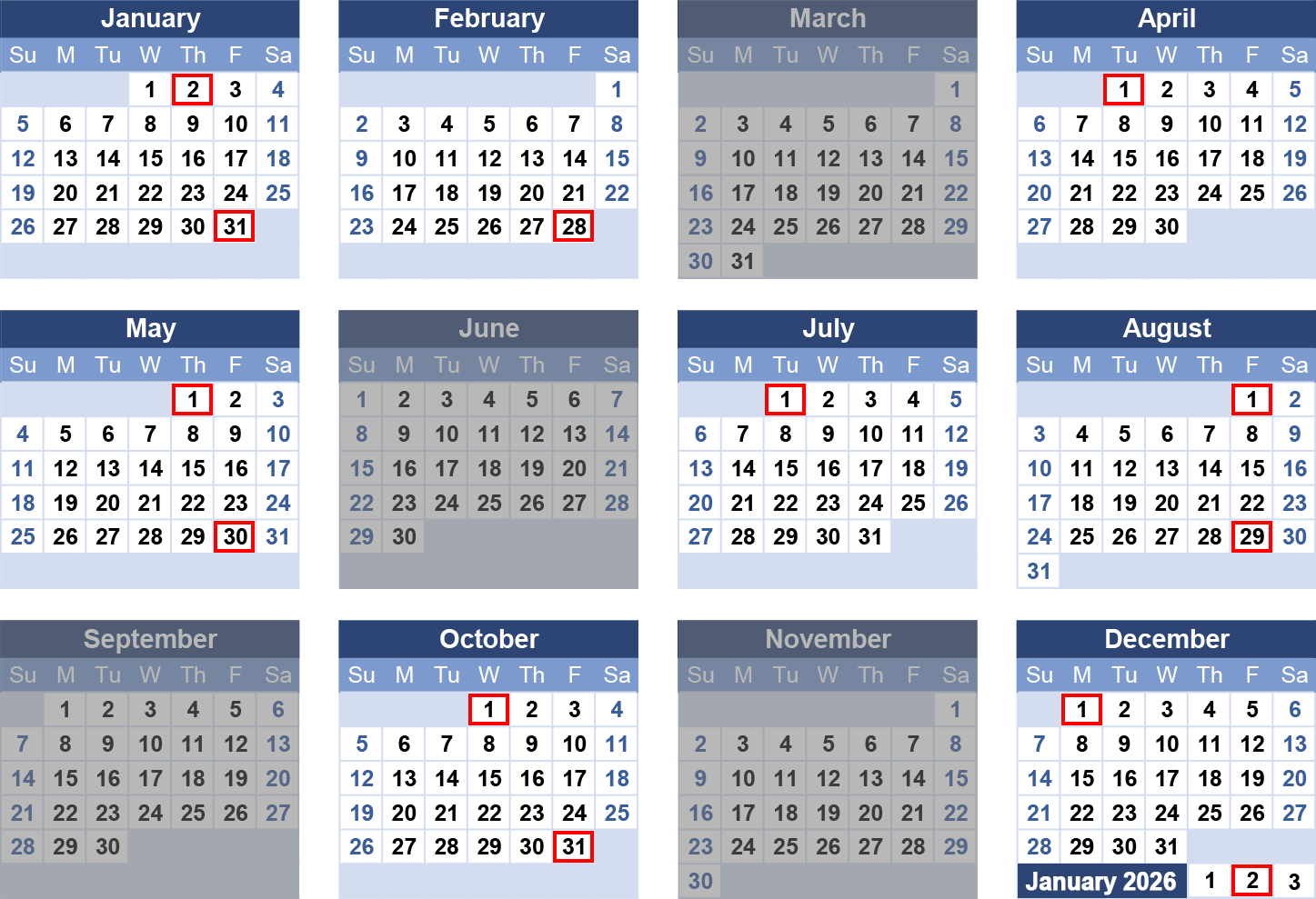

For those who receive benefits, Opers Ohio has a regular payment schedule. Generally, benefit payments are sent out on the first day of each month. If that day happens to fall on a weekend or a holiday, then the payments will be issued on the last business day of the month before. There is one small exception to this, and that is in January. For tax purposes, the payment in January must be issued on the very first business day of that month. So, you know, it is good to keep that in mind. Opers Ohio makes sure to list these dates clearly, so you always know when to expect your payments. This consistency helps people plan their budgets and manage their finances with a sense of predictability, which is, you know, quite important for daily living.

Opers Ohio provides retirement, disability, and survivor provisions for more than one million public employees, offering a steady hand and a sense of security for millions of Ohio's retired public workers and their families since 1935. Their online account is a great way to stay connected, letting you manage your retirement account, view benefits, and even apply for retirement. They offer three plan options, and understanding these, along with eligibility groups, helps you maximize your provisions. While healthcare coverage is not a requirement for them, Opers Ohio recognizes its importance and helps you consider your options as you transition to retirement. Your contributions help fund the pension, and Opers Ohio provides clear payment schedules and resources like handbooks and tax guides, aiming to be a trusted partner throughout your career and retirement from public employment.

Related Resources:

Detail Author:

- Name : Amely Little

- Username : qkreiger

- Email : murazik.destiney@gmail.com

- Birthdate : 1988-07-25

- Address : 4198 Dane Trail Apt. 349 Wolffshire, MT 18478-8255

- Phone : +1 (704) 435-0324

- Company : Herman Inc

- Job : Elementary and Secondary School Administrators

- Bio : Ea incidunt id quia vitae. Ut molestiae dolor veritatis quidem. Dolorem numquam eius nihil dignissimos.

Socials

facebook:

- url : https://facebook.com/ankundingl

- username : ankundingl

- bio : Vero possimus minima hic.

- followers : 4993

- following : 303

tiktok:

- url : https://tiktok.com/@lila_xx

- username : lila_xx

- bio : Mollitia et quis vero explicabo tempora minus.

- followers : 1097

- following : 1549