For anyone living or owning property in Fort Bend County, knowing how property values are figured out is, you know, a pretty big deal. The Fort Bend Central Appraisal District, often called FBCAD, plays a truly important part in how property values are figured out and how taxes are handled in our area. They are the folks who work to make sure that all taxable property within the county gets a fair market value assessment, which then helps determine what you might owe in property taxes. This process, as a matter of fact, is something that touches almost everyone here.

This organization, which is, like, an independent governmental body set up under Texas rules, has a main job: to look at all the property and give it a value that is, more or less, what it would sell for on the open market. This helps keep things fair for everyone who pays property taxes. It's not just about setting a number; it's about making sure that number reflects what's happening in the real estate market for properties all around Fort Bend County. So, it's about making sure things are done in a fair way for all property owners.

When it comes to getting a clearer picture of your property's value, or even understanding how tax rates get decided, there are some good places to look for information. This includes details about things like special exemptions for certain types of housing or how to go about asking questions if you think something isn't quite right with your property's valuation. We'll go through some of the ways you can find out more about these topics and where to get answers to your specific questions about property values and taxes in Fort Bend County, which, you know, can sometimes feel a bit complicated.

Table of Contents

- How Does Fort Bend CAD TX Figure Out Property Values?

- What About Special Cases for Fort Bend CAD TX Appraisals?

- Where Can You Find Information About Fort Bend CAD TX Values and Taxes?

- Who Can Help You With Your Fort Bend CAD TX Questions?

- A Look at the History of Fort Bend CAD TX

- How Does Fort Bend CAD TX Manage All That Data?

- What Kind of Support Does Fort Bend CAD TX Offer to the Community?

- Important Things to Remember About Fort Bend CAD TX Information

How Does Fort Bend CAD TX Figure Out Property Values?

The Fort Bend Central Appraisal District, which is a key part of our county's financial structure, has a main job: to look at and figure out the worth of property for local taxing bodies. This is for what's called "ad valorem" taxation, which just means taxes based on the value of something. They do this for every local taxing unit that operates within the boundaries of the district, which, you know, covers a lot of ground. So, in some respects, their work is about making sure everyone pays their fair share based on what their property is worth.

Each year, the district handles a very large number of property accounts. We are talking about something like 428,000 accounts that need to be looked at and given a value. This represents a really big total market worth across the county, which is, well, quite significant. The process involves a lot of work to assess each piece of property and make sure the value is accurate for tax purposes. This is, basically, a continuous process throughout the year.

One specific area where they set a particular rate is for low-income housing. This is done following a specific part of the Texas Property Tax Code, Section 11.1825 (r). The tax appraisal district of Fort Bend County lets the public know what "capitalization rate" they will use for the upcoming tax year, like for 2025, to value properties that get special exemptions under this section. This rate, you know, helps determine the value of these particular kinds of properties for tax purposes. It's a rather specific calculation.

- Amc Theater Crestwood Illinois

- Howell Nature Center

- Who Does Ronaldo Play For

- Fort Belvoir Community Hospital

- Boyne Mountain Michigan

It is important to remember that properties that have limits on their rent, often called "rent-restricted properties," can be very different from one another. This means that while there's a general approach, each property might have its own unique features that need to be considered when figuring out its value. So, the appraisal process takes into account these differences to make sure the valuation is fair and correct for each one, which is, of course, a lot of detailed work.

What About Special Cases for Fort Bend CAD TX Appraisals?

For those who own business personal property, there are appraisers from the Fort Bend Central Appraisal District who go out and inspect businesses. These folks are available to help with any questions you might have about your business property's valuation. They are there to offer assistance and clarity on the appraisal process for commercial items, which, you know, can sometimes be a bit different from residential property. So, if you own a business, they are a good resource.

Also, it's worth noting that legal descriptions and the amounts of land area provided by the appraisal district are meant for their own internal use. If you plan to use this information for legal reasons or in official documents, it is really important that you check it yourself to make sure it is correct. You should get in touch with the appraisal district directly to confirm all the details for accuracy before you rely on them for any formal purpose. This is, basically, a safeguard to prevent issues down the line.

The Fort Bend Central Appraisal District also has a special group called the Agricultural Advisory Board. This board is made up of landowners who have accounts that receive a special agricultural valuation, which is, you know, a particular way of valuing land used for farming or ranching. These board members bring their skills, their advice, and their overall understanding to help fill in any gaps in knowledge that the district might have regarding agricultural appraisals. They are, in a way, a very helpful resource for the district.

The main idea behind an advisory board, especially for the Fort Bend Central Appraisal District, is to offer guidance. They are there to provide suggestions that help the district improve and meet its goals, particularly when it comes to how agricultural properties are valued. This means they are a source of practical advice that assists the district in doing its job well for the agricultural community. It's a cooperative effort, you see, that really helps things run smoothly.

Where Can You Find Information About Fort Bend CAD TX Values and Taxes?

The main website for the Fort Bend Central Appraisal District, which is fbcad.org, has information specifically about property values. It's a place where you can look up the assessed value of properties. However, it's important to know that this particular website only shows information related to values. It doesn't, for example, give you details about what your estimated taxes might be, or the tax rates, or how those rates are decided upon. So, it's a good spot for valuation data, but not for tax bill specifics.

If you are looking for information about estimated taxes, what the tax rates are, and how those rates are adopted, you will need to go to a different website. You can find this information by visiting www.fortbendtax.org. It's a separate place because the tax office handles those specific details. When you click on the link to go to fortbendtax.org from the Fort Bend Central Appraisal District’s website, you will be leaving their site. This is just a heads-up so you know where you are going, which, you know, is pretty straightforward.

For paying your property taxes, there is a specific website for Fort Bend County property tax payments. On this site, you can look at your tax bill, print it out, and even make a payment. It's a convenient way to handle your tax obligations from home. So, if you are ready to settle your property taxes, that is the place to go. It's designed to make the payment process easier for everyone, which, you know, is a good thing.

The Fort Bend County Tax Office is also now collecting payments for several specific entities. If you are a resident of the Village of Pleak, or if your property falls under Fort Bend County LID #2, Fort Bend ESD #10, or The Park at Eldridge PID, you can now pay your property taxes at any of the Fort Bend County Tax Office locations. This means more options for people in those areas to get their tax payments in, which is, quite helpful for many. It just makes things a little more accessible.

Who Can Help You With Your Fort Bend CAD TX Questions?

If you have any questions about your property tax bills, statements, setting up payment plans, or anything related to your tax accounts and collection, the Fort Bend Tax Office is the place to go. They are the people who handle all those kinds of inquiries. So, if you are confused about a bill or need to discuss how to pay, they are ready to help you out. It's, basically, their main area of work.

For agents who work with property owners, the Fort Bend Central Appraisal District has systems that allow them to look at accounts that are linked to their specific ID. They can also see any appeals that are currently open, and they have the ability to submit different kinds of forms, like an AOA, ROA, or protests. Furthermore, agents can ask for a new date for an Appraisal Review Board (ARB) meeting or request public information. This system, you know, makes it easier for agents to manage their clients' appraisal matters.

A Look at the History of Fort Bend CAD TX

The Fort Bend Central Appraisal District, often known as FBCAD, has a history that goes back a bit. It was actually set up in 1982. This organization is considered a political subdivision of the state of Texas, which means it operates under state law to carry out a specific public function. Its original reason for being created was to find and put a value on property for ad valorem tax purposes, which, you know, is a way of taxing based on property worth. They do this for every local taxing unit that exists within the district's geographical boundaries. So, it's been around for a good long while, helping with property valuation.

This long-standing presence means that the Fort Bend Central Appraisal District has quite a bit of experience in its field. Since 1982, they have been working to ensure that property values are assessed fairly and accurately across Fort Bend County. This history, in a way, shows their commitment to their primary role in the local tax system. It's a continuous effort that, basically, helps support all the public services that depend on property tax revenue.

How Does Fort Bend CAD TX Manage All That Data?

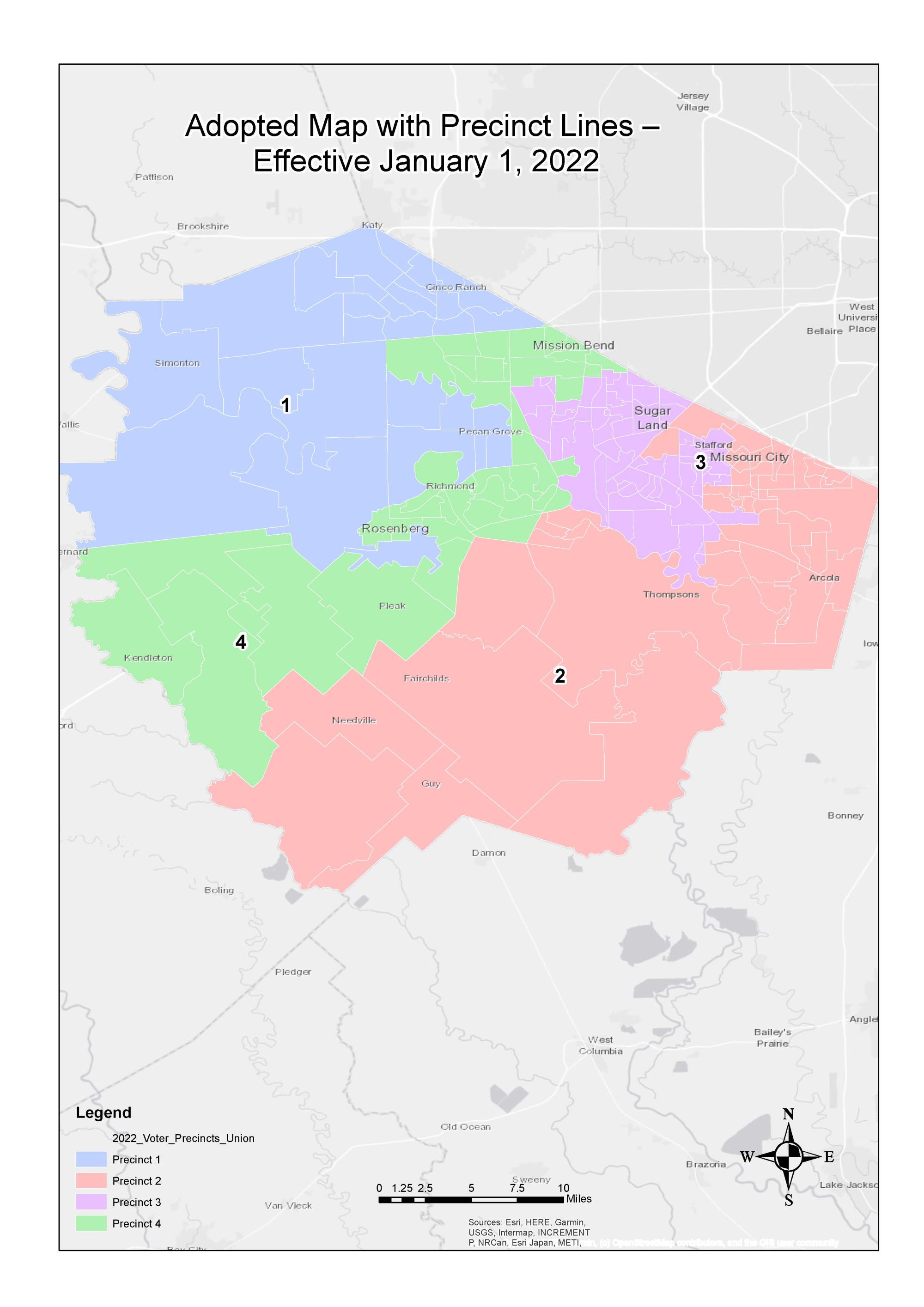

The Fort Bend Central Appraisal District uses something called a Geographic Information System, or GIS, to help with its work. A GIS is, you know, a pretty useful combination of different things: data, software, hardware, and people who are skilled in using it all. When all these parts come together, it allows the district to look at and study geographic information in a visual way. This helps them make good, well-thought-out decisions about property. It's a tool that, in some respects, helps them organize a lot of information.

This system lets them see how different pieces of land and properties relate to each other geographically. It helps them understand patterns and connections that might not be obvious otherwise. By visualizing and analyzing this geographic data, the Fort Bend Central Appraisal District can gain better insights into property values and how they might be affected by their location and surroundings. It's, basically, a very powerful way to handle spatial information for their appraisal tasks.

What Kind of Support Does Fort Bend CAD TX Offer to the Community?

The Fort Bend Central Appraisal District offers an interactive map that you can explore. This map provides geographic and property information, which, you know, can be really helpful for people looking for details about specific areas or parcels of land. It allows you to visually see different properties and their locations within Fort Bend County. So, if you are curious about a certain piece of property or just want to get a better sense of the county's layout, this map is a pretty good resource to check out.

The information that the Fort Bend Central Appraisal District collects and maintains is also used by the Texas Comptroller of Public Accounts. The Comptroller uses this data to keep an eye on how accurate and consistent the appraisal district's work is. This means there's an outside party checking to make sure that the Fort Bend Central Appraisal District is doing its job well and fairly. It's a way to ensure that the appraisal process meets certain standards and is, basically, reliable.

When it comes to the sales price of your property, the Fort Bend Central Appraisal District treats this information as private. They will not share this information with others, except in specific situations, like during a value protest hearing. This means that, for the most part, the amount your property sold for is kept confidential. It's a measure to protect your personal financial details related to property sales, which, you know, is something many people appreciate.

Important Things to Remember About Fort Bend CAD TX Information

For truly complete property data, it's a good idea to use the information that is officially recorded at the county clerk's office. Alternatively, you can get in touch with your city's public works or engineering department. These places often have the most thorough and official records for property details. So, if you need something that is absolutely official and comprehensive, those are the places to check, which, you know, can save you some trouble later on.

There's also a property tax database available through texas.gov/propertytaxes. On this state website, you can find a link to your own local property tax database. This makes it pretty simple to get information about your property taxes, including how much each entity that taxes your property will ask for if they go ahead with their proposed tax rate. It's a straightforward way to stay informed about what you might owe and to whom, which is, basically, very helpful for budgeting.

It's important to understand that the Fort Bend Central Appraisal District is not responsible for any flaws, mistakes, or things that might be left out in the information they provide. They are also not responsible for any special, accidental, indirect, or other types of damages that might happen because of these issues. This includes things like money you might have lost, data that might have gone missing, or your business being interrupted as a result. The information they give out is meant for research purposes only, which, you know, is a very clear disclaimer.

So, while the Fort Bend Central Appraisal District offers a lot of helpful information and resources, it's always a good practice to verify important details through official channels, especially if you plan to use them for legal or financial decisions. Their goal is to provide accurate appraisals for tax purposes, and they offer many ways to access and understand that information, which, you know, helps keep things transparent for the community.

Related Resources:

Detail Author:

- Name : Kelton Dooley

- Username : bchristiansen

- Email : gcrona@yahoo.com

- Birthdate : 2006-05-23

- Address : 7663 Morissette Curve Apt. 050 West Corenefurt, MD 73638-1332

- Phone : +1-262-427-4036

- Company : Pacocha-Mayert

- Job : Equal Opportunity Representative

- Bio : Labore rem velit debitis. Non fugiat eos sint ea facilis sit optio. Minus ipsa cumque sunt in quos. Inventore vel quia repudiandae temporibus quo accusamus ut.

Socials

instagram:

- url : https://instagram.com/schroeder1972

- username : schroeder1972

- bio : Unde quod aut quae est ut omnis dignissimos eius. Facere nihil ea qui voluptate sunt eum qui et.

- followers : 1906

- following : 2152

facebook:

- url : https://facebook.com/schroeder1979

- username : schroeder1979

- bio : Saepe qui qui nobis at sint quaerat.

- followers : 4778

- following : 1147

linkedin:

- url : https://linkedin.com/in/berniece_real

- username : berniece_real

- bio : Quo maiores harum eaque.

- followers : 5224

- following : 2614

tiktok:

- url : https://tiktok.com/@berniece6702

- username : berniece6702

- bio : Velit est incidunt atque rerum aut aperiam consequuntur.

- followers : 3433

- following : 1260