For anyone running a small business, having the right kind of protection in place is, you know, absolutely essential. It's about feeling secure, really, when you're out there doing your thing, whether that's building something, helping people with their finances, or even just walking dogs. Thimble insurance comes into the picture offering a way to get that peace of mind without a lot of fuss or a huge bill, which is pretty nice, actually.

This approach to getting covered is quite refreshing, allowing business owners to pick and choose exactly when and for how long they need a safety net. You see, it’s not always about committing to a whole year of payments when your work might be more, well, on-and-off. This particular provider understands that, offering policies that fit right into your actual working schedule, which is, I mean, a pretty clever idea if you think about it.

So, if you've been looking for a straightforward way to keep your operations safe, or perhaps you're just starting out and need to get some basics sorted, thimble insurance could be a very interesting option to explore. It aims to simplify what can sometimes feel like a rather complicated subject, making it much more approachable for folks who just want to get on with their work, you know, without too much extra worry.

- Childrens Hospital Of Wisconsin

- Williamsburg Outlet Mall

- Daryls House Restaurant

- Amc Loews Crestwood 18 Crestwood Il

- Maryland Institute College Of Art

Table of Contents

- What's the Big Deal with Thimble Insurance?

- How Flexible is Thimble Insurance for Your Business Needs?

- What Kinds of Protection Does Thimble Insurance Offer?

- Does Thimble Insurance Cover My Kind of Work?

- How Does Getting Thimble Insurance Actually Work?

- What About Getting Help with Thimble Insurance?

- Who Stands Behind Thimble Insurance?

- What Makes Thimble Insurance Different?

What's the Big Deal with Thimble Insurance?

Well, for small businesses, the big deal is pretty clear: it’s about having choices and not being stuck with something that doesn’t quite fit. Thimble insurance gives you the power to pick how long your coverage lasts, whether that’s just for a single job, a whole month, or even a full year. This sort of choice can really make a difference for someone who, say, does contract work and doesn't always have a steady flow of projects. You can get just what you need, when you need it, which is, honestly, a rather smart way to manage your business expenses.

The idea here is to make getting covered much less of a headache. Instead of long forms and waiting around, you can get a price estimate and even get approved online almost right away. This speed means you can, you know, get your protection sorted and then get back to doing what you do best, without a lot of wasted time. It’s a pretty quick process, which is, I mean, something many busy people appreciate.

This approach also means you are in charge. You can make changes to your policy or even stop it altogether whenever your business situation shifts. That kind of control is, like, a really important feature for small business owners whose work schedules and needs can change pretty often. It helps you stay nimble, you know, and adapt to whatever comes your way.

- Hyderabad Airport International

- Schweitzer Ski Resort

- Rc Willey Reno

- Hotel Riu Palace Antillas

- Atlantic Fish Company Boston

How Flexible is Thimble Insurance for Your Business Needs?

The flexibility offered by thimble insurance is, in some respects, one of its most talked-about features. Think about it: you might have a big project that lasts a few days, or maybe you’re doing something for just an hour. With this kind of setup, you can get coverage that matches that exact timeframe. It means you’re not paying for protection you don’t actually need, which, honestly, can save you a good bit of money over time.

For example, if you’re a consultant with a single, short-term contract, you could get a policy just for that period. Or, if you’re a seasonal business, you could have coverage for just those busy months. This ability to get protection by the hour, day, or week is, you know, quite different from how many traditional insurance plans work. It really puts the power in your hands to decide what makes sense for your particular situation, which is, like, a very welcome change for many.

This flexibility extends to how you manage your policy, too. Once you have it, you can pause it if things slow down, or extend it if a job runs longer than expected. You can even do this from your phone, which is, you know, super convenient when you're out and about. It means your protection can really move with your work, offering a kind of peace of mind that adapts to your actual business life, which is pretty helpful.

What Kinds of Protection Does Thimble Insurance Offer?

When you’re running a small business, there are different kinds of situations where you might need a safety net. Thimble insurance offers a range of options to help cover various risks that can pop up. For instance, there's general liability, which is, you know, a pretty common type of protection that helps if someone gets hurt on your property or if you accidentally damage something that belongs to someone else while you’re working. It’s a foundational piece of security for many operations, actually.

Then there’s professional liability, which is a bit different. This kind of protection is for when someone says your advice or your service caused them a problem, like if a consultant gives bad advice. And, you know, in today’s connected world, there’s also cyber protection, which helps if your business data gets into the wrong hands. These options give you a broader sense of security, really, covering more specific types of risks that businesses face.

They also offer something called workers' compensation insurance. This is, you know, a very important kind of business protection that looks out for your team members if they get hurt or become unwell while they are working for you. It can even cover you if you work by yourself, which is, I mean, a pretty good thing to know. Plus, there's a business owners policy, or BOP, which, you know, bundles general liability with commercial property protection, making it a rather neat package for many small places of business.

Does Thimble Insurance Cover My Kind of Work?

It’s a fair question, isn’t it, whether your specific kind of work is something that thimble insurance can actually cover? Well, the good news is that they aim to provide protection for a really wide array of jobs and professions, over three hundred different types, actually. So, chances are, whatever it is you do, there’s a good chance they have something that fits. This broad reach is, like, a very helpful aspect for a diverse group of small business owners.

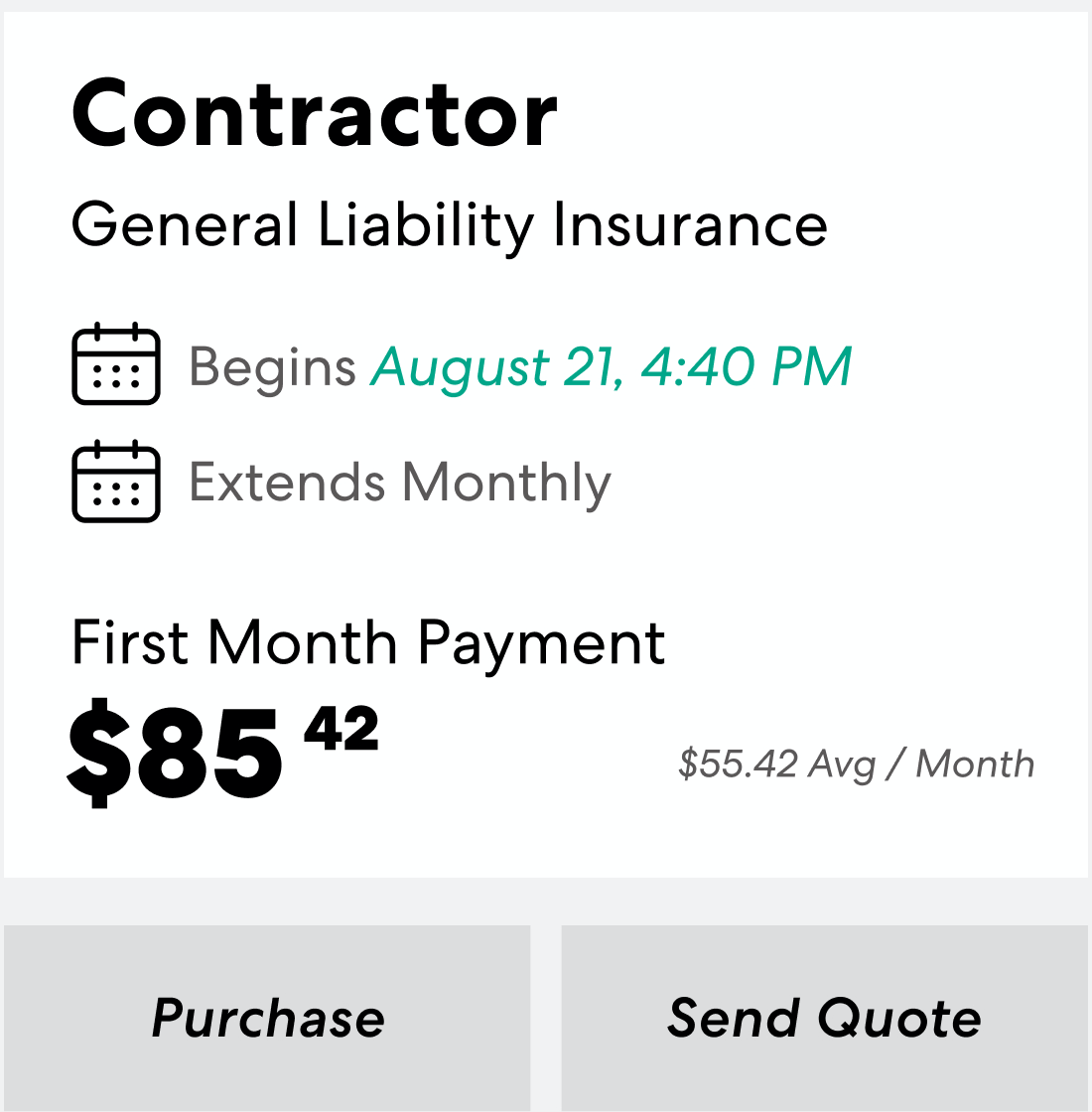

For example, if you’re a contractor, someone who builds things or fixes them, they have options for you. Same goes for people who work for themselves, like freelancers, or folks who are handy with tools. Fitness professionals, pet sitters, even restaurants and retail places can find something that works for their particular setup. It’s pretty inclusive, you know, which makes it easier for many different kinds of small operations to get the protection they need.

They also arrange general liability protection for consultants and landscapers, among others. The idea is to make sure that a wide variety of people, doing all sorts of different jobs, can find a way to keep their business safe and sound. So, if you’re wondering if your specific work is covered by thimble insurance, it’s worth checking, because the list of professions they can help is, you know, quite extensive.

How Does Getting Thimble Insurance Actually Work?

Getting thimble insurance is designed to be pretty straightforward, which is, you know, a welcome relief for many people. You can go online and get a price estimate for your protection in just a few minutes. It’s not a long, drawn-out process. This means you can quickly figure out what your options are and how much it might cost, which is, like, a very useful first step when you’re trying to sort out your business needs.

Once you’ve decided on a policy, you can get it approved right there and then, online. This immediate approval is, honestly, a pretty big deal, especially if you need protection quickly for a new job or project. There’s no waiting around for papers to be processed or for someone to call you back. You can get your proof of protection, like digital certificates, almost right away, which is, you know, super helpful for getting started.

And once you have your policy, managing it is also made simple. You can use an app on your phone to get those digital certificates, or to pause your protection if you don’t need it for a bit, or even to extend it if a job goes longer than planned. It’s all about putting the power to manage your own protection right in your hands, which is, I mean, a very practical approach for today’s busy business owner. You just put in your phone number, and they send you a link, which is pretty easy.

What About Getting Help with Thimble Insurance?

Even with something designed to be simple, sometimes you just need to talk to someone or get a question answered. Thimble insurance understands this, offering ways to get in touch if you need a hand. You can reach out through chat support, which is, you know, great for quick questions when you’re online. Or, if you prefer, you can send them an email, which is, like, another good option for getting help.

Their team is available during regular business hours, from Monday through Friday, 9 in the morning until 6 in the evening, Eastern Standard Time. This means there are real people ready to assist you during the typical workday, which is, you know, comforting to know. They also have a list of ways to get in touch, so you can pick the one that works best for you, which is pretty thoughtful.

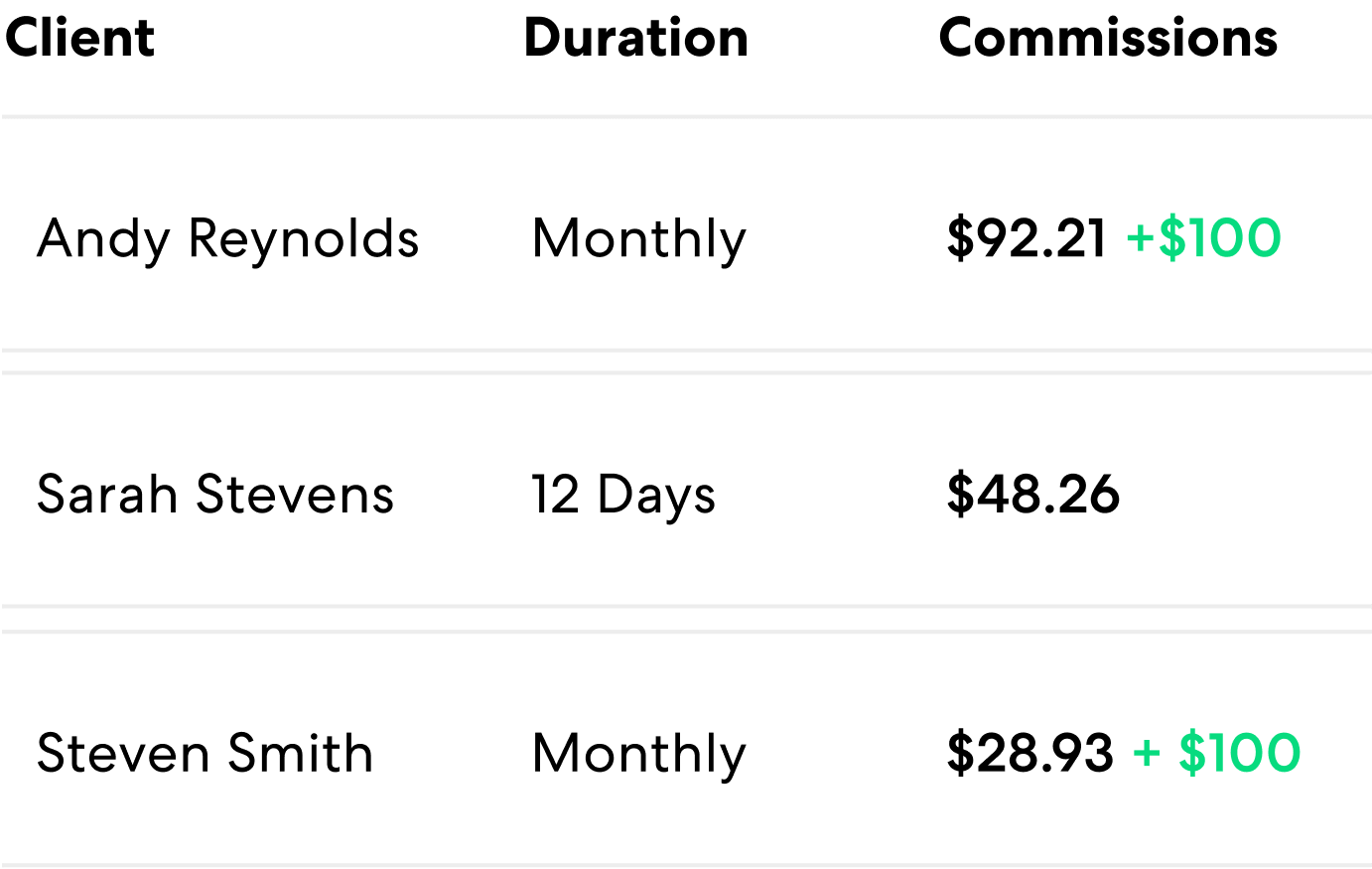

For insurance agents, there’s even a special help center built just for them and their agencies. This shows that they are, you know, thinking about everyone involved in the process, making sure that agents have the tools they need to help their clients effectively. It’s all part of making the whole experience of getting and managing thimble insurance as smooth as possible for everyone involved, which is, honestly, a pretty good thing.

Who Stands Behind Thimble Insurance?

It’s always good to know who is, you know, actually providing the protection when you get an insurance policy. For thimble insurance, the policies are supported by some pretty well-known names in the insurance world. One of the companies that stands behind these policies is Markel Insurance Company. They are, you know, a very large company, actually listed on the New York Stock Exchange, and they are even part of the Fortune 500, which means they are a very significant business.

Another company that supports these policies is National Specialty Insurance Company. This company is, like, a part of State National Insurance Company, which is another established name in the business. Knowing that these kinds of companies are the ones underwriting the policies can give you a lot of confidence in the protection you’re getting. It means there’s a solid financial backing for the promises made by thimble insurance, which is, you know, very important for peace of mind.

This background helps to show that while the way you get and manage your protection might be new and modern, the actual financial support behind the policies comes from long-standing and respected institutions. It’s a blend of new ways of doing things with, you know, traditional strength, which can be a pretty good combination for many small business owners looking for dependable coverage.

What Makes Thimble Insurance Different?

What really makes thimble insurance stand out is, in some respects, how much control it gives to the person buying the protection. It’s described as being the first provider that truly puts its customers in charge, which is, you know, a pretty bold statement but one that seems to hold up when you look at how it works. This focus on customer control is, like, a core part of their approach, setting them apart from many other options.

Small businesses, no matter their size, can get a policy quickly, whether they need it for a single job, a month, or a whole year. And the key part is, they can change or cancel it whenever they need to. This ability to modify or stop your protection at any point, without a lot of hassle, is, you know, a significant difference. It means your protection truly adapts to your business’s rhythm, which is very helpful for unpredictable work.

They also offer tools to help contractors stay on top of compliance, which is, I mean, a very practical feature. Plus, there’s a review available that talks about the costs, what’s covered, and the good and less good points of their business protection. This kind of openness and the practical tools they offer really highlight their different way of doing things, making thimble insurance a distinct option for those seeking a more flexible and manageable kind of protection for their operations.

This article has explored how thimble insurance provides flexible and affordable protection for small businesses, allowing coverage by the job, month, or year. We looked at the various types of protection available, including general liability, professional liability, cyber protection, workers' compensation, and business owners policies. The discussion covered the wide range of professions that can be covered, from contractors to pet sitters, and how the process of getting and managing a policy works, emphasizing immediate online quotes and approvals. We also touched upon the support options for customers and agents, and the reputable companies that stand behind the policies. Finally, we considered what makes thimble insurance unique, particularly its focus on customer control and adaptable policy durations.

Related Resources:

Detail Author:

- Name : Mr. Melany Kuhlman

- Username : jerel.welch

- Email : omills@casper.net

- Birthdate : 1988-01-08

- Address : 2231 Erica Island Daughertyberg, IA 63525-5568

- Phone : +1 (540) 631-1974

- Company : Cronin Inc

- Job : Optometrist

- Bio : Aut dolorem eligendi nihil odit voluptatibus omnis. Aut sed nihil et nobis corrupti delectus optio porro. Asperiores qui laborum iure. Veritatis eum in consequuntur sit perferendis consequatur.

Socials

facebook:

- url : https://facebook.com/mannc

- username : mannc

- bio : Aperiam odit sunt iusto quo debitis ad. Quam voluptatum aut fugiat et.

- followers : 4100

- following : 1042

linkedin:

- url : https://linkedin.com/in/ceasar4660

- username : ceasar4660

- bio : Reiciendis vel ab sint quod.

- followers : 4525

- following : 2025

twitter:

- url : https://twitter.com/ceasar_mann

- username : ceasar_mann

- bio : Enim est dolorem voluptatem saepe qui. Sed ullam aut explicabo eum non ut odio repudiandae. Harum consequatur repellat officiis eligendi rem hic aperiam.

- followers : 4900

- following : 1946

instagram:

- url : https://instagram.com/ceasarmann

- username : ceasarmann

- bio : Reiciendis id alias ullam officia. Praesentium laboriosam eius quaerat repellat in.

- followers : 2671

- following : 1330